Scrap the Routine.

|

Request a Platform

Demo Today

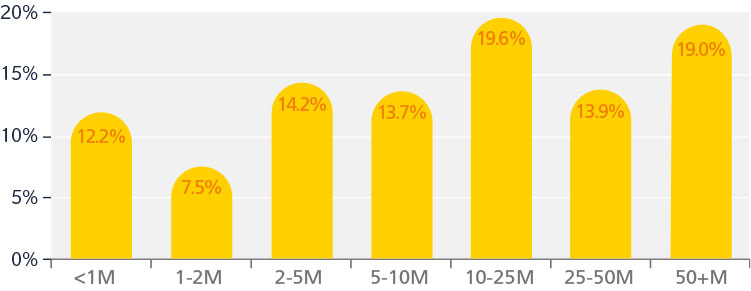

Trade Size Distribution €

Source: Tradeweb, 2020 full year data, European ETF platform only

Leveraging our technology and diverse network of liquidity providers, you have access to all Asian, European and U.S.-listed ETFs and can execute block, risk or NAV trades. All with local market ETF teams providing real-time support.

A Greater Pre-trade Transparency and Competitive Prices

Gain greater market visibility from live dealer streams, axes and historic dealer stats. Put multiple liquidity providers in competition when requesting one-way or two-way quotes.

A New Generation of Automated Trading

- Execute large volumes of trades efficiently using pre-programmed execution rules, fully tailored to each of your trading strategies using our automated intelligent execution tool (AiEX)

- Full market visibility complemented by the ability to execute trades on a single screen, giving you the power to act immediately on your trading decisions

- Multi-dealer RFQ to streamline your workflow, minimising the need to juggle multiple calls and chat windows to get the trade done

Advanced Trade Analytics with TCA

Harness our comprehensive data and unrivalled composite to uncover actionable insights to enhance your ETF trading strategies.

©2020 Tradeweb Markets LLC. All rights reserved.